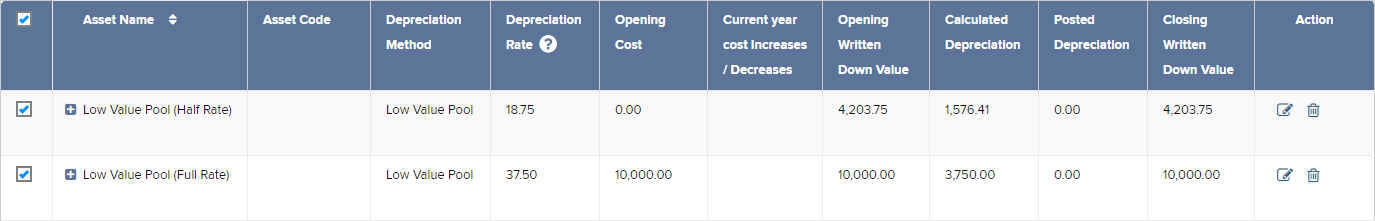

Low value pool depreciation calculation

Sep 21 2020 The low value pool deduction is a clever strategy that lots of property. Basically the requirement is.

Pooling An Asset Au Myob Practice Myob Help Centre

Property investors who place assets in the low-value pool are able to claim them at a rate of 1875 per cent in the year of purchase regardless of how long the property has been.

. Pool balance before depreciation Xero. Irrespective of the acquisition date full year for the first year apply 1875 depreciation. From that year onwards the taxpayer can put the asset into the low-value pool and it will be depreciated at 375 on the diminishing value basis from then on.

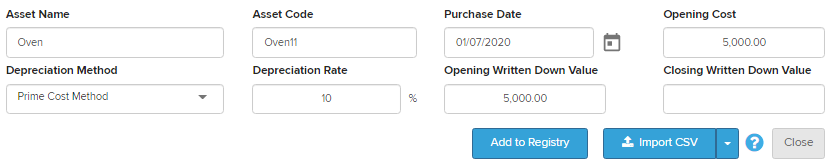

If you have a low cost asset with a net book value of AUD 80000 the first-year depreciation for the asset will be 1875 percent of the AUD 80000 or AUD 15000. Assets that cost or have an adjusted tax value of 5000 or less can be depreciated. Are available for calculating depreciation on most assets and you can switch freely between the two.

In the first year that an asset is acquired and allocated to the low value pool its low value pool deduction can be calculated at a rate of 1875. Low value assets. A taxpayer can choose.

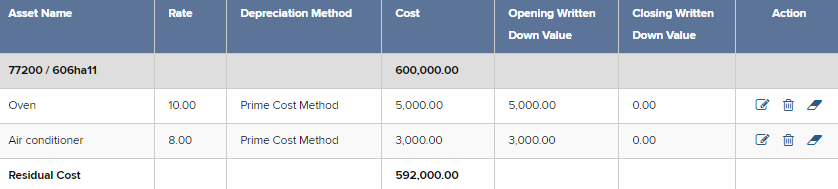

For instance a widget-making machine is said to. Pooling assets You can group low value assets together and depreciate as a pool. This rate applies regardless.

If you have already been using the diminishing value method for a previous tax year and the. A rate of 375 is generally applied to the pool balance. About 4110000 results 0 seconds How The Low Value Pool Deduction Can Help To Maximise.

Up to 8 cash back Low Value Pool Full rate 3750 half rate 1875 If you set up a custom pool you can set your own depreciation rate. You work out your low-value pool deduction using a diminishing value rate. There is 2 rates of depreciation 1875 for the first year and 375 for subsequent years.

Up to 16 March 2020. From the second year on 375. However a rate of 1875 that is half the normal pool.

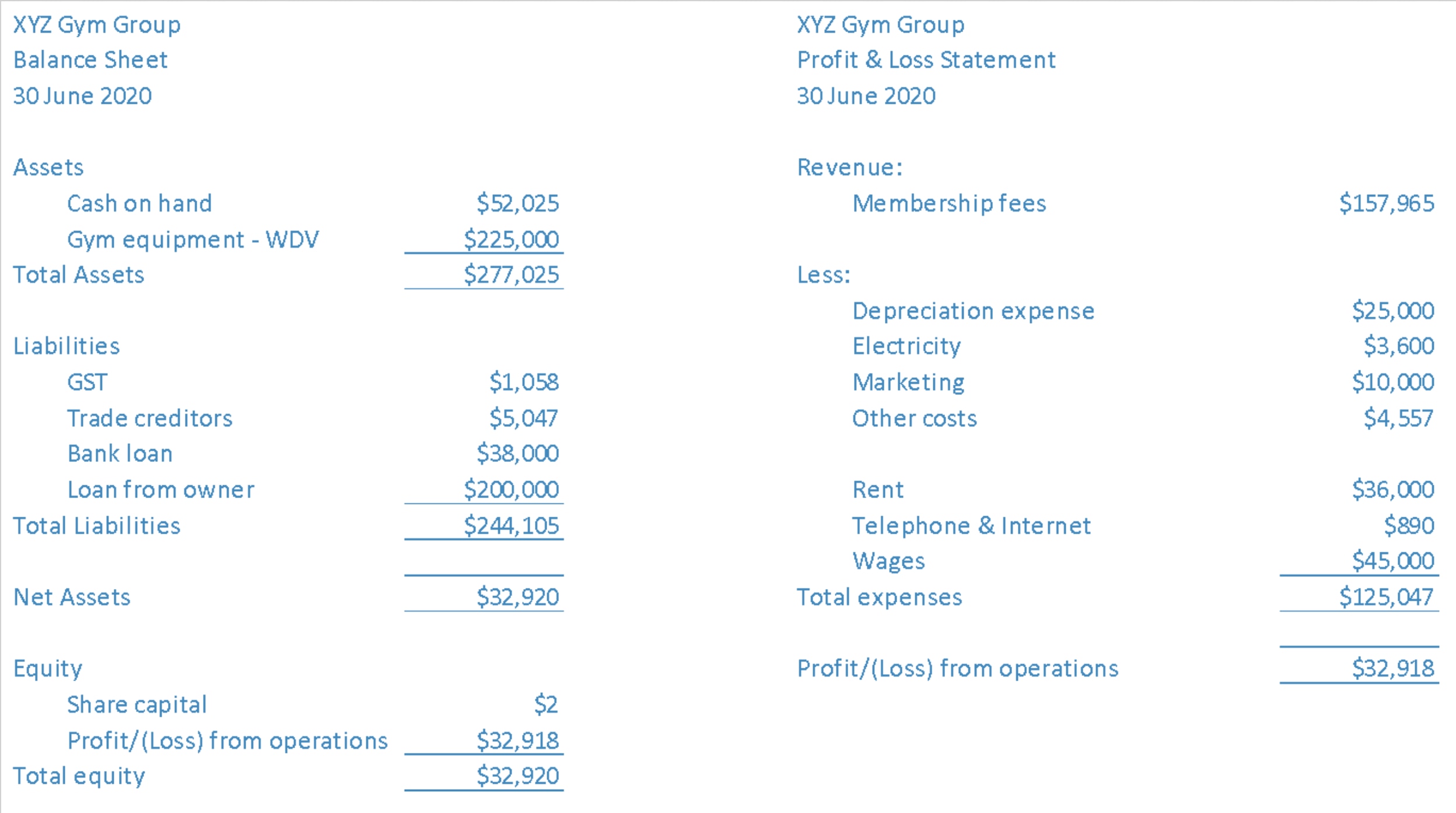

Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. Threshold reset to 1000.

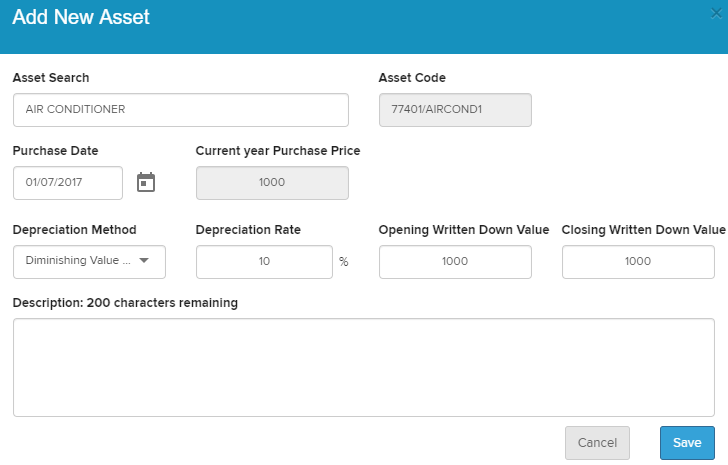

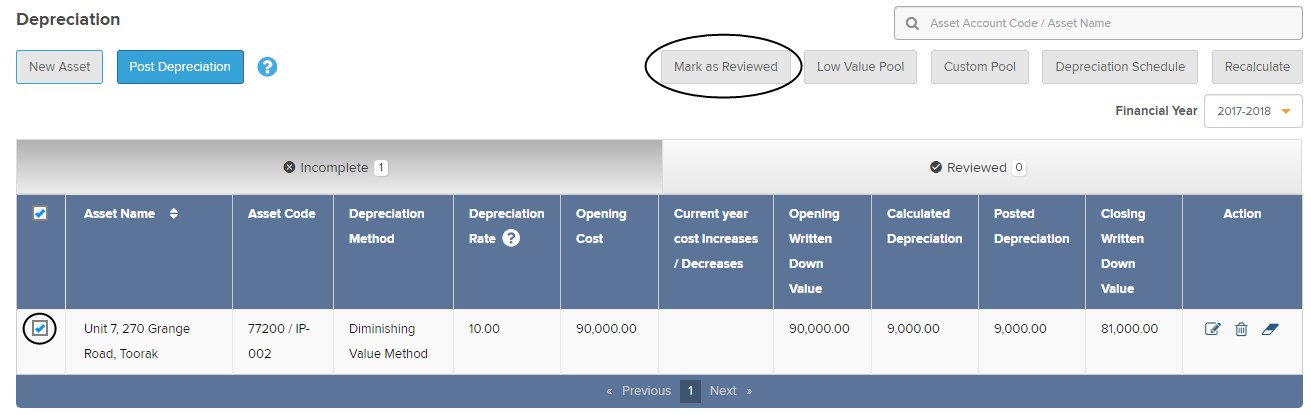

Depreciation Schedule Simple Fund 360 Knowledge Centre

Depreciation Schedule Simple Fund 360 Knowledge Centre

Ifrs 16 Assets Of Low Value Annual Reporting

Itr Depreciation Rental Property Low Value Pool Deduction D6 Lodgeit

Itr Depreciation Low Value Pool Business Related In Individual Tax Return Lodgeit

Depreciation Schedule Simple Fund 360 Knowledge Centre

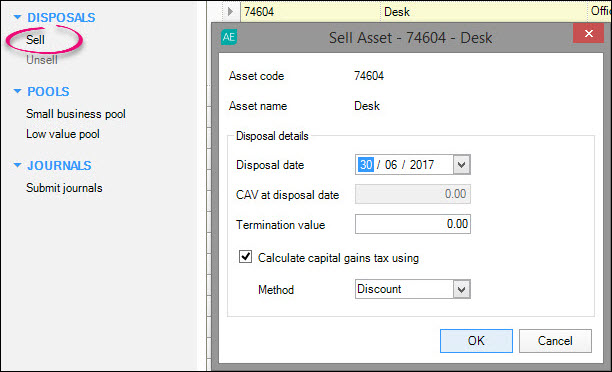

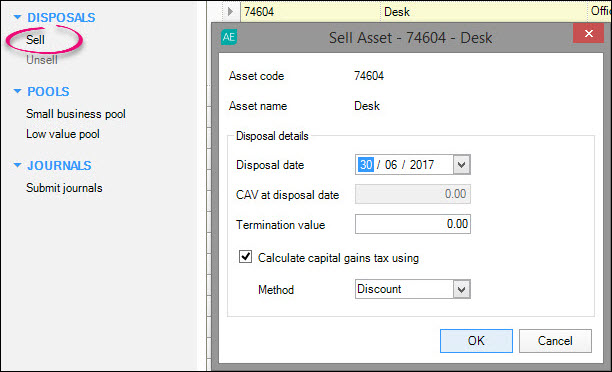

Selling A Low Value Pool Asset Ps Help Client Accounting Help Myob Help Centre

Changes To Our Schedules Tax Property Depreciation Schedule

Itr Depreciation Low Value Pool Business Related In Individual Tax Return Lodgeit

Item D6 Low Value Pool Deduction Ps Help Tax Australia 2019 Myob Help Centre

Depreciation Schedule Simple Fund 360 Knowledge Centre

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Depreciation Schedule Simple Fund 360 Knowledge Centre

Itr Depreciation Low Value Pool Business Related In Individual Tax Return Lodgeit

Depreciation Schedule Simple Fund 360 Knowledge Centre

Accounting Vs Tax Depreciation Why Do Both Quickbooks

The 20 000 Instant Asset Write Off And Small Business Entity Sbe Threshold Changes Nexia Edwards Marshall Nt